India Ratings & Research (Ind-Ra) has assigned JK Tyres & Industries' (JKTIL) Rs 400 million term deposit programme an 'A+' rating.

India Ratings & Research (Ind-Ra) has assigned JK Tyres & Industries' (JKTIL) Rs 400 million term deposit programme an 'A+' rating.

The ratings are supported by JKTIL's established position in the Indian Tyre industry as the third-largest tyre manufacturer. It has an established relationship with customers which include major original equipment manufacturers (OEMs), state transport units and large fleet management companies.

The ratings are supported by JKTIL's established position in the Indian Tyre industry as the third-largest tyre manufacturer. It has an established relationship with customers which include major original equipment manufacturers (OEMs), state transport units and large fleet management companies.

JKTIL is likely to benefit from the increasing trend of radialisation in the CV segment (industry reports - FYE13: around 20%) due to its established track record in the segment. Contribution from the company's radial segment (passenger radial, CV radial) increased to 42% (FY13: 35%) of the domestic revenue in 9MFY14. The upcoming radial capacities in Chennai will increase the overall revenue contribution to over 60% of the domestic revenue by FY17. This will also increase JKTIL's EBITDA margins in the medium- to long-term as radial tyres are priced higher than bias tyres.

Ind-Ra expects marginal deterioration in financial leverage in FY15 on account of the debt-funded capex in both India and Mexico. However, as the capex in India is coming up in phases, Ind-Ra expects leverage to fall below 3x, FY16 onwards in the absence of any further expansion plans. JKTIL reported consolidated net leverage (net adjusted debt/EBITDAR) of 4.2x in FY13 (FY12: 6.2x).

Competition in the Indian tyre industry is intensifying due to the increasing focus of international players and expansion by domestic players. Several tyre manufacturers have announced large capex plans keeping in mind the long-term growth prospects of the Indian market. However, in the medium term, a slower-than-expected demand revival could lead to overcapacity in certain segments and intensify competition in the industry. This could negatively impact profitability and credit metrics of tyre companies including JKTIL.

Rating Sensitivities

Positive: Higher-than-expected deleveraging of the balance sheet through higher-than-expected benefits from the expansion and/or a significant improvement in demand resulting in improvements in the revenue and operating profits leading to lower-than-expected net leverage is a positive rating guideline.

Negative: A negative rating action could result from lower-than-expected profitability due to delays in benefits from upcoming projects and/or higher input costs and/or pricing pressure due to weak demand resulting in consolidated net leverage exceeding 3x beyond FY16.

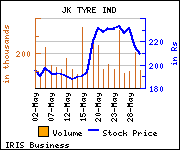

Shares of the company declined Rs 5.85, or 2.72%, to settle at Rs 209. The total volume of shares traded was 103,904 at the BSE (Friday).